Solving the challenge of reaching the unreached

with our technology and distribution expertise, we offer - “an end-to-end solution for Banking and Financial” services in a transparent, efficient and an effective manner.

Get Started30

K+100

K+40

+75

M+Who are we?

A Technology platform for rural banking and last mile agent banking as an extension to core banking systems

Who are we?

A Technology platform for rural banking and last mile agent banking as an extension to core banking systems

Sectors

Financial Inclusion

At atyati, we are committed to promoting financial inclusion through our FI operations. Financial inclusion is about providing essential financial services and products to those who are currently unserved or underserved. It's an effort to make everyday financial services accessible and affordable to everyone, regardless of financial status.

Business Correspondence

At atyati, our business correspondents expand financial services to rural, urban and semi urban areas. BCs, are representatives of banks who play a crucial role in helping villagers open bank accounts and access financial services. Their activities are like opening new accounts, processing transactions, and facilitating loans.

Technology

With the aid of cutting-edge technology, banking institutions have the potential to reach the pinnacle of business performance by prioritizing superior customer service, implementing robust risk management strategies, and fostering operational synergies. By seamlessly integrating innovative technological solutions.

Meet The Team

Director & CEO

Together, we challenge ourselves for a better tomorrow by meaningful designs that help live our best life and maintain lasting relevance.

Prakash brings over 25 years of deep expertise in the Banking domain, with a distinguished focus while enabling Financial Inclusion, Rural Banking, Microfinance through his wide understanding on Technology. Prakash is a Veteran Leader in building the Fintech solutions for the Rural Banking & Financial Inclusion. As a strategic innovator, he has consistently driven business growth by implementing groundbreaking strategies in rapidly changing environments. As a CEO, and Director of atyati, Prakash has transformed the company into one of India’s foremost last-mile banking service organizations. Under his visionary leadership, atyati has set benchmarks in enabling financial access to underserved communities across the country. Prakash continues to steer atyati toward ambitious growth objectives, leveraging his wealth of knowledge and commitment to delivering impactful solutions in the financial ecosystem.

Director

Together, we challenge ourselves for a better tomorrow by meaningful designs that help live our best life and maintain lasting relevance.

Rajan is the President & CEO of Metrod Holdings Berhad, Malaysia. He has extensive experience in managing cross disciplinary corporate functions ranging from marketing, supply chain management and business process re-engineering among many other functions. An alumni of Wharton school, he focuses on value creation within organisations and has helped many organisations realise success through his nuanced approach to management.

Director

Together, we challenge ourselves for a better tomorrow by meaningful designs that help live our best life and maintain lasting relevance.

Presently serving as the President & CEO of Metdist Ltd, Uday leverages his vast four decade strong experience in the commodities industry to help Metdist outshine its peers. In the course of his career, he has held many senior positions across multiple organisations which have greatly benefited from his expertise and experience.

Director

Together, we challenge ourselves for a better tomorrow by meaningful designs that help live our best life and maintain lasting relevance.

Prasad is a Chartered accountant and a member of ICAI since 1990. He serves in an advisory role on the boards of many leading organisations. His extensive understanding of business processes has allowed him to immensely add value to the transformative processes of organisations.

Our Products

MFI

atyati’s microfinance (MFI) platform allows banks to manage the complete microfinancing cycle through its branches or BC partners. MFI allows banks to track sourcing, servicing and collections for the complete portfolio at the bank or BC level.

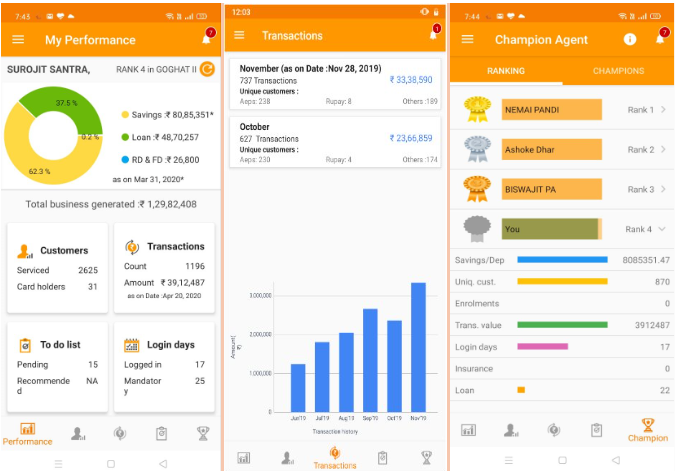

Swayam and Aayaam

Swayam and Aayam application suite exemplify our commitment to innovation and operational efficiency. Aayam, the agent dashboard, streamlines agent activities with real-time insights, gamification, and a comprehensive feature set.

ganaseva

atyati pioneers Financial Technology, placing technology at the heart of our operations. With our advanced ganaseva platform, we provide a comprehensive suite of banking services to rural, semi-urban, automated delivery mechanism ensures access to all.

Ganak

Ganak, developed by atyati, is a groundbreaking platform showcasing our commitment to innovation in financial inclusion. Utilizing AI, ML algorithms, text extraction, data categorization, This eliminates manual verifications.

USP

atyati technologies enables banks & financial institutions to provide financial services efficiently in a cost-effective manner to last mile customers through its technology and distribution network.

Authenticity

We act genuinely, believing in the importance of our actions and interactions, prioritizing the welfare of all stakeholders in our ecosystem.

Compassion

Our commitment to improving lives goes beyond empathy. We proactively engage with stakeholders, seeking to understand their needs and making a positive impact, even in rural employment opportunities.

Resourcefulness

Rooted in Indian values, we embrace simplicity and focus on execution, doing more with less. Atyatians embody this ethos, pushing boundaries to deliver excellence and solve societal problems.

Excellence

Excellence is our foundation, evident in every action, collaboration, innovation, and teamwork. The enduring tenure of our BC and MBC agents reflects our commitment to excellence and a people-oriented culture.

What Customer say about us

My name is Anita Pawar. I opened a grocery store with a loan of Rs. 50,000 from the Atyati Company in the Indi branch. I am able to pay the loan back installments from the business's profits, and my family also benefits financially from the additional profit as we work from home. I`d like to add that the atyati Company has been quite gracious in providing a loan to us

My name is Shamim Khatoon married to Meraj Kaif,. We came from a very low income background and had no one to help us. After that, I became aware of atyati and Jana Bank's group lending program and got in touch with their local relationship manager. I organized a group of women and submitted an application for a 50,000 rupee loan. With that money I opened a modest grocery store in my neighborhood.

My name is Akkayamma, and I am running a successful onion business. I received a 50,000 loan from the kunigal branch of the atyati organization. When I required a loan I went to the banks and requested documentation. Since I didn't have any, I was not granted the loan. However, later, the atyati group came to my home and provided the loan without requiring any original documentation.

Our Clients

Subscribe to Our NewsLetter

Stay informed and never miss an update! Subscribe to our newsletter to receive the latest news, updates, promotions, and exclusive offers directly to your inbox. Be the first to know about new products, upcoming events, and insightful content tailored just for you. Don't miss out – sign up now and join our community of subscribers!