ganaseva digital lending platform

ganaseva digital lending platform enables financial institutions to streamline lending and offer their customers the convenience of self-service digital loan experiences. Aimed at making loan origination simple, the solution turns lending into a quick, painless process and helps to sustain customer-centric digital experiences at scale. It replaces traditional loan processes with dynamic loan application and provide them with the best lending experience.

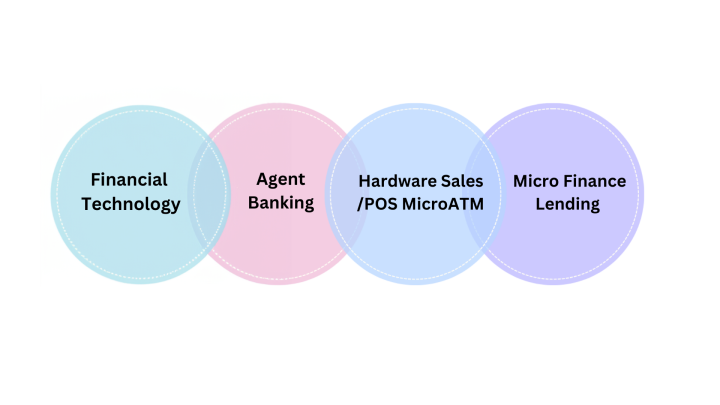

What we make?

We build custom software that drives innovation and social impact

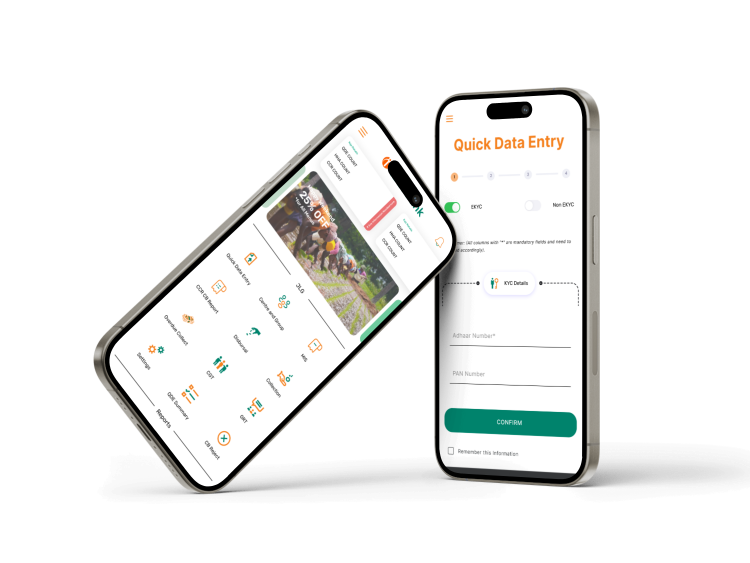

One of the key pillars of our impact in rural India is the implementation of group lending, aligning with generic Microfinance norms. This approach not only fosters financial cooperation within communities but also provides a structured framework for individuals with limited financial literacy to engage in economic activities and uplift their standards of living. The paperless approach to customer onboarding and account opening represents a paradigm shift in rural banking. We ensure a hassle-free and environmentally conscious process, eliminating paperwork and bureaucracy. This not only expedites the financial inclusion process but also reduces the barriers for individuals who might be deterred by complex documentation requirements.

Our Products

We proudly introduce our wholly owned technological marvel

Ganak

GANAK plays a major role in the credit underwriting process, which helps credit organization by providing different analysis to take decision in sanction/disbursal process.

ganaseva

ganaseva digital lending platform offers flexibility to banking and NBFC clients through on-premises deployment or cloud-based access.

FI Gateway

The Financial Inclusion gateway solution of atyati (“ganaseva”) is a switch application to allow communication between MicoATM and CBS to manage last mile customers banking appetite

MFI

atyati’ s microfinance (MFI) platform allows banks to manage the complete microfinancing cycle through its branches or BC partners.

LOS SaaS

Our SaaS LOS represents a comprehensive digital lending solution, catering to a broad spectrum of financial institutions including Banks, NBFCs, and FinTech’s. Our suite encompasses digital onboarding, loan origination, rule engine, and APIs.

AMS

atyati is managing more than 25000+ FI agents and 5000+ MFI Agents across Banks, it is very important to maintain all the mandatory documents of agents centrally onboarded by us. This would help us during any fraud committed by agents, insurance claims and more importantly to make business decisions

Our Impact

atyati Technologies has emerged in the realm of financial technology. With an unwavering commitment to fostering innovation and promoting financial inclusion, atyati has undergone transformative phases, marking key milestones in its journey. Multi-Channel Gateway, capable of handling requests/response from various channels including thick & thin clients. We have Integration experience with all reputed Core banking systems, Internal or third party Aadhar Vault seeding for account opening and transactions.