Future of FinTech Operations on the wheels of Intelligence

Ganapati Nayak and AIML Team 17 Apr 2025

In the world of MFI businesses, collecting repayments on time is essential to maintaining a steady cash flow and smooth operations. However, predicting when and how customers will repay is a challenge. Without accurate predictions, this poses challenges to operations team to identify high-risk customers, prioritize follow-ups, and plan resources effectively. This can result in inefficiencies, delayed payments, higher collection costs, and strained relationships with customers which eventually strikes bottom-line of balance sheet as well as reputation loss to stakeholders.

How this was attempted through Machine Learning at atyati

To overcome these challenges, ML team embarked on Repayment Prediction Model in the anticipation to forecasts customer’s possible repay patterns based on data from past behaviour, customer habits, and other influencing factors.

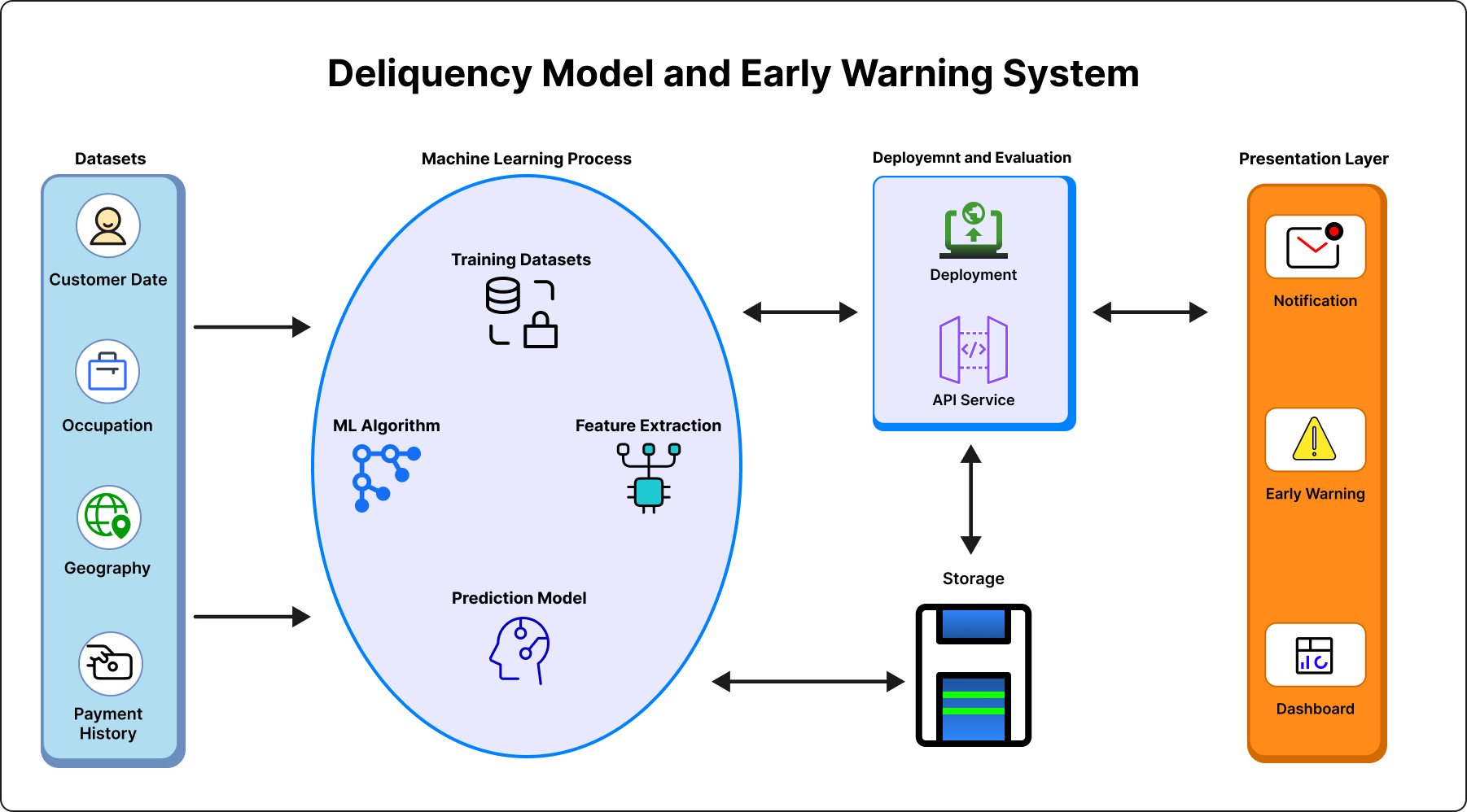

Bi product of above model yielded a solution to address possible Delinquency which invariably cemented way for generating Early Warning System (EWS), which helps to exercise extra bit of caution to field staff before they fall in defaulter bucket. By analysing historical data, borrower characteristics, and loan details, this model allows to-spot high-risk borrowers and make better lending decisions ultimately reducing defaults and eliminate risk associated with unsecured lending.

Process as per standard procedure

- Data Collection: This journey started with gathering a variety of data sources to feed into the model:

- Borrower Information: Extensive customer profiling which include details like personal information (good/bad practices), payment patterns, and loan history.

- Group Dynamics: Extra bit of information of the group/member during sourcing, and social connections could impact good Vs bad borrowers which apparent to impact loan repayment.

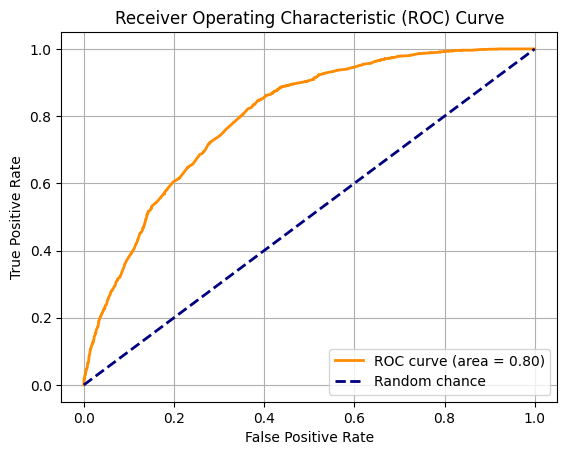

- Model Training: Endeavour to produce indigenous model was the thought initially, however, creating wrappers on top of existing algorithms was no brainer to start with. The RF algorithm was chosen due to its robustness and versatility in handling both classification and regression tasks. Applying ROC-AUC metric signified evaluation process alongside performance of classification models. Feature engineering was pivotal in improving the predictive accuracy of the RF model. Several critical features were derived to capture essential patterns in the data by making use of large volume of data to train a MLD to recognize patterns influencing loan repayments. The model was designed to consider both individual borrower traits and the group dynamics within MFI.

- Testing the Model: Final Iteration conducted to tweak critical attributes while testing real-world data evaluated accuracy of the repayment-prediction behaviour. Usage of metrics like precision, recall, and accuracy to ensure the model worked well and could predict repayment likelihood.

- Insights and Results: The model helped extracting high-risk borrowers upfront, which allowed operation/business team to apply proactive steps and manage loan portfolio more effectively.

Impact on Internal Operations

- Reduced Default Rates: By proactively identifying high-risk borrowers, atyati’s business team was able to intervene sooner, reducing defaults. For example, if the model reduces defaults by 30%, helps in reducing as much FLDG obligation and translate back in the company’s profit book and minimizing write-off costs.

- Optimized Resource Allocation: The model assisted in prioritizing loans with a higher likelihood of repayment, enabling the business team to allocate resources more effectively.

- Scalability:Initially exercise applied on MFI portfolio, however, it proved effective across a range of loan types, viz. individual and personal loans. Regardless of the sector, the model could adapt effortlessly, allowing for expansion of operations without compromising quality.

Business Statistics

In today’s tussle between lenders and borrowers (arguably in MFI lending), usage of technology to resolve ground zero problems are critical. Invariably AI techniques opened the pandora box of opportunities to innovate and assist business plus operations team. AI strategy of atyati enabled field team to appreciate and accept digitization. Well, there will be element of reluctance to adopt initially, however, the benefits and right training helped to eliminate the initial apprehension in the Field Officer minds.

Finally, the model played a crucial role in efficiency gains. One of the biggest challenges the team faced was the enormous amount of manual effort involved in assessing loan risks. It was tedious work that often led to delays and errors. But with the model’s automation, the team reduced the manual effort by 20%, leading to significant reductions in operational overhead.

Initially, the model's accuracy was high, but as the model provided early warnings, the subsequent drop in accuracy became less important. This was because the operations team benefited from improved collection efficiency, which significantly served the purpose of creating the model.

Continuous Monitoring and Model Enhancement

Unlike traditional programming solution Input plus Program is not always desired output. Model required consistent refinement by placing concrete output again to fine tune models. This trick is very critical in AI based solution to keep the model effective, three important steps followed at atyati:

- Monitor Performance: Regularly check how well the model is performing and gather feedback from Data Engineer (BO knowledge is super critical).

- Retrain the Model: Update the model with new/additional data, especially when customer behaviours or regional economic conditions change.

- Incorporate Feedback: Use business team feedback to fine-tune the model and improve its accuracy.

By continually refining this model, we ensure it continues to provide value to our operations and supports our goals of reducing defaults and improving repayment success.