Revolutionizing JLG & SHG Loan Management: atyati’s Next-Gen LMS for Financial Inclusion

Raghavendra Hegde 13 May 2025

Indian Government and Regulatory bodies like the RBI & MFIN continuing emphasizing Financial Inclusion Initiatives, Banks have set targets for lending to SHGs and JLGs as part of their Priority Sector Lending obligations, and this focus is likely to continue or even intensify for the next few years. Rural lending continued to be a key focus for the Public/Private Sector Banks with 40% PSL target given in the Mater Direction of the RBI Guidelines on PSL, a significant chunk of this will go to SHGs and JLGs. According to the CAGR Projection from IMARC, TechSci, Evolve Business Intelligence, Research Reports, JLGs and SHGs sector in India is expected to grow substantially in the range of 50-90% in next 5 years

While banks and financial institutions in India strive to meet their Priority Sector Lending targets, they continue to face significant challenges in implementation of their strategy and effectively managing JLG and SHG loan portfolios. Challenges are primarily due to limitation of the existing platforms (including erstwhile “atyati’s Ganaseva”); unexplored technology potentials; and not so easy implementation of regulatory norms periodically.

Ganaseva 2.0 NextGen Platform - A Comprehensive Solution for JLG and SHG Loan Lifecycle Management:

Atyati’s Ganaseva 2.0 is a comprehensive digital platform developed in alignment with RBIH guidelines to address the unique needs of inclusive lending. Backed by Atyati’s deep domain expertise in Lending and financial inclusion, the platform empowers financial institutions to digitalize and control the complete loan lifecycle—from customer onboarding to closure. Needless to quote on few considerations while designing, seamless rollout of regulatory compliance, operational efficiency, and flexibility rest with banks and institutions to switch-on/off few functionalities.

Our deliberate attempt to make LMS Scope wider for banks to leverage similar products like Individual loan, Gold Loan, MSME, KCC, etc based on bank’s business appetite. Financial institutions don’t have to spend too much of their bandwidth on vendor management, rather exercise their strengths in banking. Daily accrual of interest keeps accounting balance accurate and keeps pre-closure process simple. In addition to the above, daily computation also ensures correct treatment on end-customer’s repayments as per RBI guidelines.

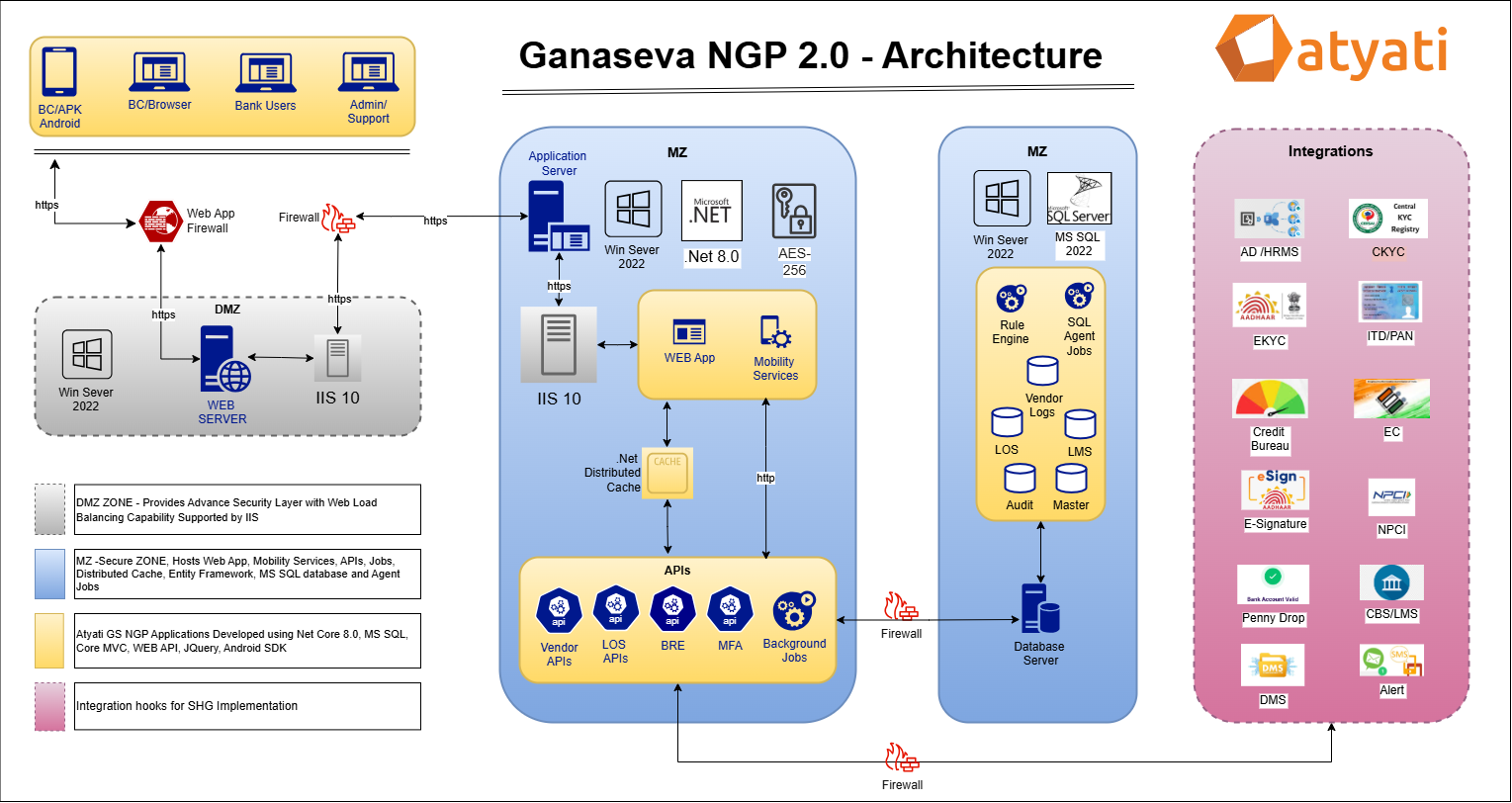

Optimized for Security, Scale and Efficiency

Designed for high-volume, short-term microfinance operations, the platform offers seamless integration with both core banking systems and Business Correspondent (BC) models. Ganaseva 2.0 NGP JLG/SHG LOS/LMS is built on the latest Microsoft stack, utilizing ASP.NET Core MVC, jQuery, and Web API to deliver a responsive, service-oriented architecture. It leverages Microsoft SQL Server for high-performance data management and adopts a microservices-based design to support modular deployment, seamless third-party integration, and elastic scalability.

The platform has distributed caching for performance, and AES-256 encryption with Multi Factor Authentication for robust security. Designed for scale and field efficiency, it offers rapid deployment, reliable operations.

Seamless Integration for End-to-End Digital Workflows

Ganaseva 2.0 ensures a fully digitized, paperless loan processing experience using built-in integration to Aadhaar-based eKYC, Central KYC Registry (CKYC), Digital Signature platforms, Credit Bureaus, and Document Management Systems (DMS). The platform also has plug-ins connect with the FI’s Active Directory (AD) and HRMS systems to streamline user management and access control. Through its secure and digitized workflows across both the LOS and LMS modules, Ganaseva 2.0 enables faster approvals, disbursals, and settlements, significantly reducing manual intervention and turnaround time.

Built-In Accounting Intelligence

Volume-intensive portfolios are retained within the Ganaseva 2.0 JLG/SHG LMS platform, however its On-Prem deployment model ensures that data resides within the bank’s premises and operates as a virtual core banking system. This design strategy minimizes day-to-day data exchange with CBS, while ensuring scalability and seamless access for branch users during sanctioning and disbursal activities a robust integrated accounting platform that enables accurate, real-time portfolio management. Daily Interest Accruals, Accumulation, Repayment, and dynamic portfolio position evaluation ensures complete visibility into portfolio performance. A comprehensive alert and notification engine drives operational efficiency by triggering timely prompts for key events such as loan disbursals, repayment reminders, and overdue alerts.

The platform is fully integrated with digital payment systems, including NEFT and IMPS for disbursals, and UPI-based channels for collections, supporting seamless end-to-end transactions. It also features a configurable asset classification engine, enabling automated identification and classification of Special Mention Accounts (SMA) and Non-Performing Assets (NPAs). The platform ensures timely NPA recognition and provisioning, in full compliance with regulatory norms and RBI guidelines.

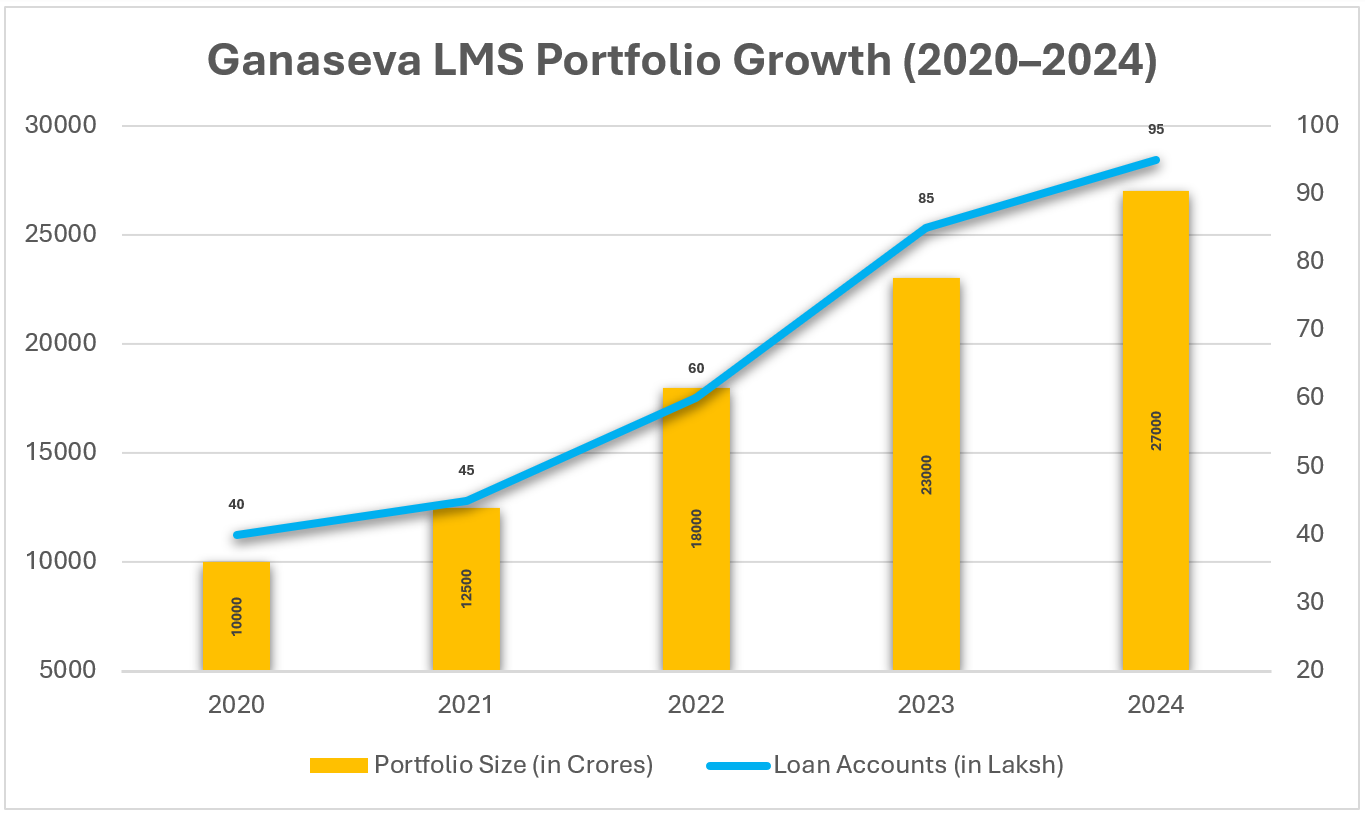

Ganaseva's Loan Management System (LMS) currently administers a loan portfolio exceeding ₹30,000 crores across more than 10 million loan accounts, providing comprehensive loan origination and servicing capabilities for several of India's leading financial institutions.

The platform integrates with Core Banking System APIs to facilitate end-of-day (EOD) reconciliation of General Ledger (GL) accounts. Supports branch-wise repayment tracking and automated GL reconciliation, ensuring financial accuracy and alignment across systems.

Risk Insights and CNPA Integration

The LMS offers advanced dashboards to track collection, overdue, doubtful assets, and portfolio risk by geography, BC or Branch hierarchy which help banks and financial institutions mitigate risk by ensuring that defaulters are quickly identified and their loans are appropriately categorized and managed. Integration with the Centralized NPA (CNPA) system enables real-time tagging of flagged defaulters, ensuring early risk identification and regulatory compliance.

Dynamic Product Configuration

Ganaseva 2.0 allows institutions to design dynamic loan products that adapt to regional, occupational, or community-specific requirements. Whether it’s a revolving credit line for SHGs or location-locked offerings for BC partners in specific geography, the platform enables granular control introducing customizable products with ability to configure Interest rates, repayment schedules and appropriation rules.

JLG/SHG Credit Scoring Model and Eligibility Evaluation

Due to lack of financial literacy in rural areas, inadequate credit evaluation and loosely coupled integration of LOS/LMS with Financial Institutions Centralized Credit Evaluation System may result in excessive lending.

Ganaseva LOS platform supports Configrable Scoring Framework and Evaluation Model for JLG/SHG. The system dynamically evaluates borrower profiles and determines eligibility in real-time, ensuring standardized credit assessment and faster decision-making aligned with institutional lending policies.

The Business Rule Engine allows institutions to define key parameters of Pancha-Sutra for SHG loans and waited parameters for Household Assessment for JLG Loans. System automates eligibility decisions, and flag exceptions—ensuring transparent, consistent, and policy-aligned loan eligibility check and approvals for JLG/SHG-based lending in real-time.

Ganaseva platforms capabilities to align with Bank’s Centralize Continues Credit Evaluation System and integration with the Credit Bureaus to assess the eligibility and risk during the customer onboarding and loan origination can assure effective transfer of risk management capabilities to underlaying Loan Origination Management Systems which can eliminate the risk of excessive lending.

Ganaseva 2.0: A Compliant and Scalable Platform for Inclusive Lending

Ganaseva 2.0 is a next-generation platform designed in collaboration with the Reserve Bank Innovation Hub (RBiH), aligning with RBI’s policy framework and compliance standards. The platform addresses critical domain challenges by integrating operational insights and field-ready mobility support for Business Correspondent (BC) operations. It features a compliance-driven credit evaluation engine and robust loan management capabilities, enabling institutions to manage Self-Help Group (SHG) and Joint Liability Group (JLG) loan portfolios with precision, transparency, and scalability. Designed to adapt to evolving regulatory landscapes, Ganaseva 2.0 ensures inclusive lending is seamlessly digitized while maintaining strong operational controls and robust risk governance.